The importance of Environmental, Social and Corporate Governance (ESG) is perhaps more important to the economy’s infrastructure than first anticipated. The topic of ESG, it’s ideologies and what this model can do for businesses can be somewhat confusing. This guide clarifies the key elements.

What does ESG stand for?

Simply put, ESG refers to the three main factors, environmental, social and governance, that are used in evaluating both the sustainability and societal impact of an investment in a business or company. This set of criteria is most commonly used by investors and shareholders to assess the impact that a company has on the world; it also helps companies to attract and retain funding from those who adopt a socially responsible investment strategy.

The Three Pillars

In order to fully understand ESG, it’s important to make sense of how each aspect affects a company.

Let’s start with the environmental element. Fundamentally, this element evaluates what a company does to ensure that it operates sustainably, including its action on climate change, greenhouse gas emissions and water usage. All businesses operate within the natural world and all affect it in one way or another, some more than others. The environmental factor will include aspects of the business model as well as in house practices that promote sustainability. It’s less to do with the amount of money they make per annum and more focused on their carbon footprint and environmental impacts. Initiatives such as encouraging the use of renewable energy in factories and offices and reducing the amount of water used in manufacturing processes as well as staff toilets fulfil the environmental principle and will appeal to investors who are eco aware.

The social element examines how companies manage their relationships with employees, suppliers, customers and the communities they operate within. It includes the level of diversity among employees, health and safety performance and the treatment of clients and customers of the enterprise and is important in maintaining a credible reputation. Furthermore, ensuring that this component of the ESG is met safeguards the welfare of the natural environment as it encourages organisations to be aware of how they’re impacting their surroundings. This is hugely relevant in today’s society, with new companies entering the market all the time and economic growth actively encouraged. For existing companies, expansion and development are key to surviving in a competitive and consumerist world.

Lastly, the governance element deals with a company’s leadership, pay (both executive and non executive), internal controls and shareholder rights and includes anti-corruption measures, tax transparency and the way that decisions are made across the executive board. This aspect of ESG helps to establish a corporation’s strengths in a competitive environment and also makes them stand out against competitors.

By meeting all three ESG guidelines, a company becomes more attractive to potential investors, particularly those who wish to invest responsibly, and therefore the amount of funding received will likely be increased.

Why is ESG so important?

These recommendations have far more benefits than just financial gain. By ensuring that the conditions are met, businesses have a better overall performance. Furthermore, being able to adapt a business model to suit the environment decreases the impact of disruption further down the line if changes have to be made. Investments made in renewable energy infrastructures and technology which reduce carbon emissions increase the ESG value of a company, in turn creating positive brand recognition among customers. Making these changes now is important because it safeguards the environment, makes businesses more attractive to potential investors and reduces the overall risk the economy poses on our natural world.

What’s the relevance in today’s society?

The rapid rate of growth of business and the advancement and availability of technology mean that ESG is very relevant in today’s fast-paced and industrialised society. Both technology and the climate crisis are hugely prominent currently and companies must achieve a sustainable relationship with the environment in order for the economy to continue to operate functionally and to help prevent a climate disaster.

The impacts of the coronavirus pandemic have had a dramatic effect on the UK’s economy. Statistics reveal that economic activity in April 2020 shrank by a huge 20.4%, the biggest recorded monthly fall. The lockdown measures put in place to protect the population have had a detrimental effect on the economy and recovery is going to be a lengthy process. However, the ESG model will help to support this as it holds the key to a sustainable business environment, which should hopefully be more resilient going forward into a somewhat uncertain future.

It’s significance doesn’t stop there. Today, investing in ESG has matured to the point where it has the ability to fast-track market transformation for the greater good. Investor’s decisions have the ability to shape the future, and with enough societal and governmental pressure, funding will hopefully only be given to the companies that meet the ESG model. Provided that the political framework doesn’t drastically alter in the upcoming years, market-led changes will act as a force for good. By adapting to fulfil the environmental, social and governance components outlined above, industry itself will become more eco-friendly, sustainable and open to new investments.

In Summary

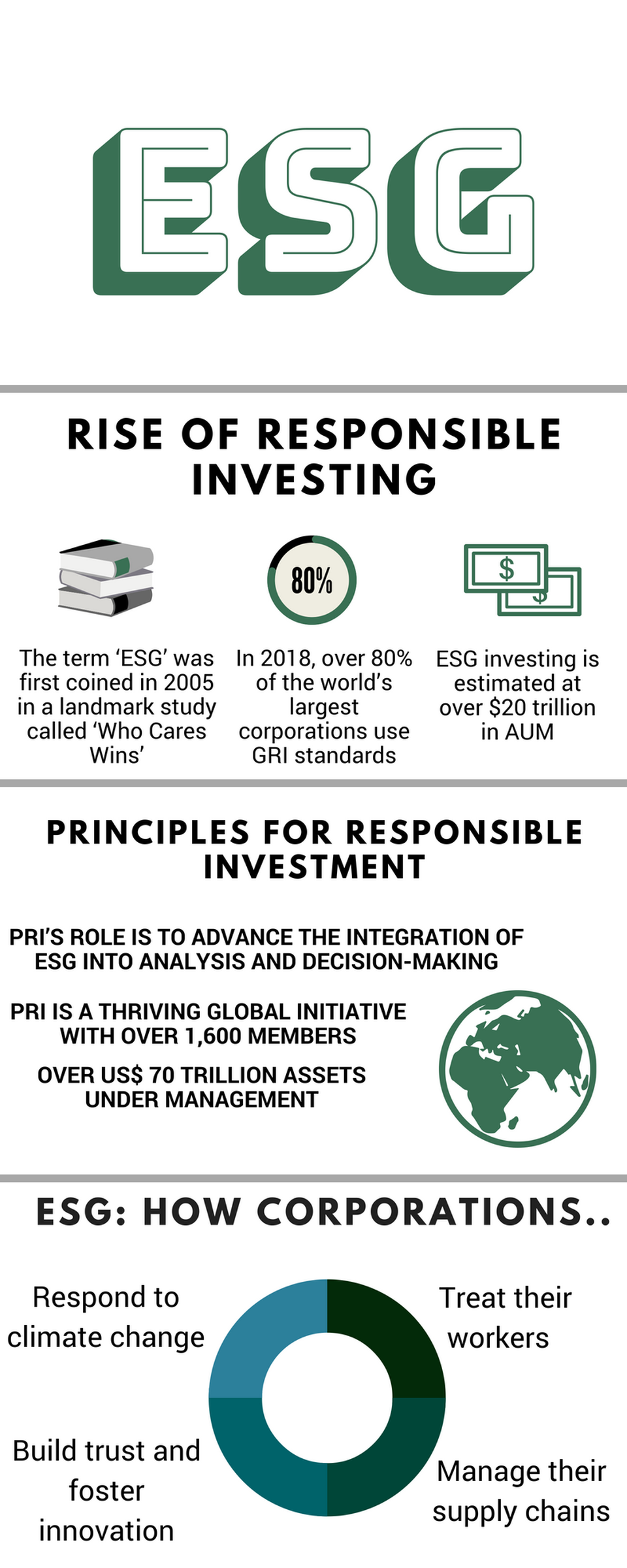

With reference to the diagram (right) the impact of these three pillars on all parts of the economy’s functionality is clear.

Making sure that organisations follow the recommended guidelines is not only a huge step forward in promoting an eco-friendly, environmentally aware approach to business, it also makes companies more attractive to investors from both the UK and overseas.

These principles ensure responsible investing – a vital component in safeguarding the economy’s sustainability. Furthermore, it helps to protect the natural environment that all companies work within and makes the workplace safer and more attractive for workers.

Encouraging corporations to adopt the ESG approach is key in ensuring long-term financial success, which will inevitably help the economy recover from the damage caused by the coronavirus pandemic. The more companies who include these three pillars in their business models the better. Encouraging businesses to tackle climate change and other environmental issues and generally operate in an eco-friendly way clarifies an approach which supports economic growth and safeguards our natural environment.

References

1: https://en.wikipedia.org/wiki/Environmental,_social_and_corporate_governance

2: https://medium.com/carbonclick/what-is-esg-and-why-is-it-important-f9036bb96d66

3: https://www.forbes.com/sites/georgkell/2018/07/11/the-remarkable-rise-of-esg

4: https://www.pwc.co.uk/services/economics/insights/uk-economic-update-covid-19.html

Anna Parkinson and The Team